Getting The Eb5 Investment Immigration To Work

Getting The Eb5 Investment Immigration To Work

Blog Article

About Eb5 Investment Immigration

Table of ContentsGet This Report about Eb5 Investment ImmigrationThe smart Trick of Eb5 Investment Immigration That Nobody is Talking AboutThe Definitive Guide for Eb5 Investment ImmigrationThe Ultimate Guide To Eb5 Investment Immigration5 Simple Techniques For Eb5 Investment Immigration

While we aim to use accurate and updated material, it needs to not be taken into consideration lawful guidance. Immigration legislations and policies are subject to change, and individual circumstances can differ widely. For individualized advice and lawful recommendations concerning your certain immigration circumstance, we strongly advise seeking advice from a certified migration lawyer who can provide you with tailored assistance and guarantee compliance with existing laws and regulations.

Citizenship, via investment. Currently, since March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Work Areas and Backwoods) and $1,050,000 elsewhere (non-TEA areas). Congress has actually accepted these quantities for the following 5 years starting March 15, 2022.

To get the EB-5 Visa, Investors should produce 10 permanent united state tasks within 2 years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Need ensures that financial investments add directly to the united state work market. This uses whether the tasks are created straight by the company or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

The Main Principles Of Eb5 Investment Immigration

These jobs are figured out via designs that make use of inputs such as growth prices (e.g., building and construction and equipment expenditures) or annual incomes produced by recurring procedures. On the other hand, under the standalone, or straight, EB-5 Program, only straight, permanent W-2 staff member placements within the business may be counted. A key risk of relying exclusively on direct employees is that staff decreases as a result of market problems can cause insufficient permanent positions, possibly leading to USCIS rejection of the financier's petition if the work creation need is not met.

The financial version after that predicts the variety of direct work the brand-new organization is most likely to produce based upon its anticipated revenues. Indirect work determined with economic models describes work generated in sectors that supply the items or services to this business straight associated with the task. These tasks are produced as an outcome of the enhanced need for items, products, or services that support business's operations.

Some Known Facts About Eb5 Investment Immigration.

An employment-based 5th preference classification (EB-5) financial investment visa offers an approach of ending up being a long-term U.S. resident for international nationals intending to spend funding in the USA. In order to make an application for this permit, an international capitalist has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Location") and develop or preserve a minimum of 10 permanent work a knockout post for USA employees (omitting the capitalist and their immediate family).

This procedure has been a tremendous success. Today, 95% of all EB-5 funding is increased and invested by Regional Centers. Since the 2008 monetary crisis, access to capital has actually been tightened and local spending plans remain to encounter significant shortfalls. In lots of regions, EB-5 investments have actually filled the funding gap, providing a brand-new, vital source of capital for neighborhood financial growth projects that renew areas, produce and sustain jobs, infrastructure, and services.

The Greatest Guide To Eb5 Investment Immigration

workers. In addition, the Congressional Budget Plan Workplace (CBO) racked up the program as income neutral, with administrative costs paid for by candidate fees. EB5 Investment Immigration. Discover More Here Greater than 25 nations, consisting of Australia and the UK, use comparable programs to attract international financial investments. The American program is more stringent than many others, needing significant risk for financiers in regards to both their economic investment and migration standing.

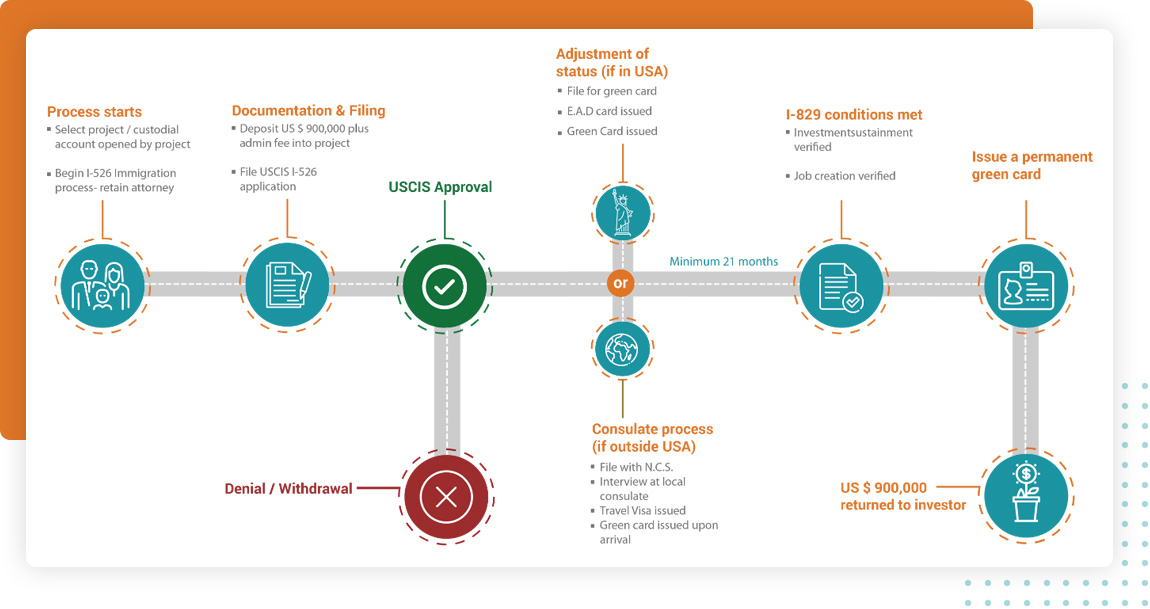

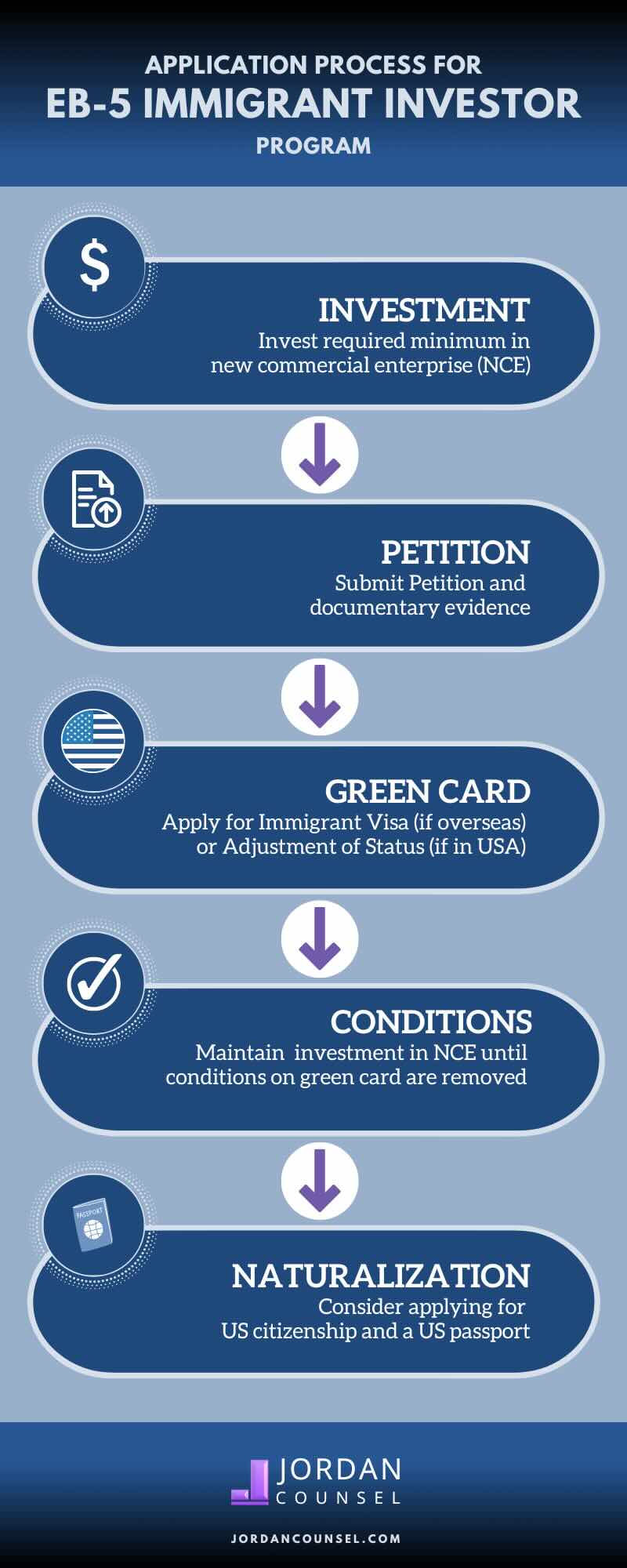

Households and individuals who seek to move to the United States on an irreversible basis can use for the EB-5 Immigrant Investor Program. The United States Citizenship and Migration Services (U.S.C.I.S.) set out different requirements to obtain irreversible residency via the EB-5 visa program.: The very first step is to find a certifying investment opportunity.

As soon as the possibility has been determined, the investor has to make the financial investment and submit an I-526 application to the united state Citizenship and Migration Services (USCIS). This application has to consist of proof of the financial investment, such as bank statements, acquisition arrangements, and service strategies. The USCIS will assess the I-526 petition and either authorize it or demand additional evidence.

Get This Report on Eb5 Investment Immigration

The investor needs to look for conditional residency by sending an I-485 petition. This request must be sent within six months of the I-526 authorization and should consist of proof that the investment was made and that it has produced a minimum of 10 full time tasks for U.S. employees. The USCIS will certainly assess the I-485 application and either approve it or request additional proof.

Report this page